"AI For PE" Startups Are Missing the Point

Why I'm bearish on most "Copilot for Private Equity" startups, and where I see actual opportunity

Welcome to Fully Distributed, a newsletter about AI, crypto, and other cutting-edge technology. Join our growing community by subscribing here:

Recently, there’s been a flurry of “Copilot for Private Equity” startups - I counted more than a few in the last two YC batches alone. Unfortunately, I think most of them are working on the wrong problem. The real value unlock, in my view, is not in supercharging investors, but in supercharging their portfolio companies.

Let me tell you why.

PE Workflows Are NOT a “Hair On Fire Problem”

Cost savings don’t move the needle

Most AI startups today are trying to automate “low-impact” but highly time-consuming investor workflows. Some popular examples below:

Faster data room searches

Streamlining internal reporting

Organizing and summarizing call notes

Automate legal doc review / drafting

However, given that the fund’s top line is a function of management fees (charged as a % of Assets Under Management) and carried interest (~20% of the realized profit), most of the proposed AI solutions do not boost revenues in any meaningful or obvious/direct way. This means that the main benefit to the fund is cost/time savings.

But here is the thing - these productivity gains do not really move the needle for this end customer. Let’s look at some illustrative economics of a typical fund.

A $2.5B fund will make ~$250M per year (carried interest + management fees):

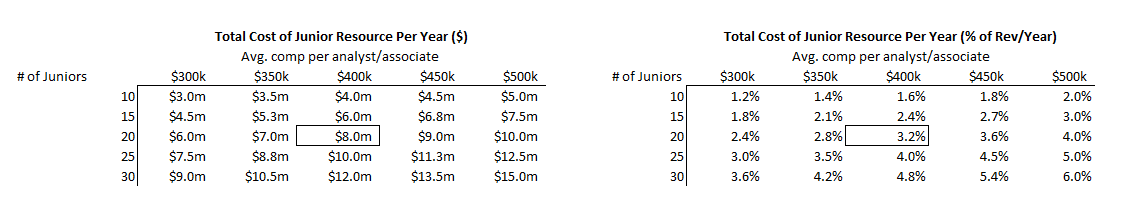

Junior resources (who are typically responsible for most of these ‘automatable’ tasks) will cost the fund anywhere from $3M-$15M per year (depending on team size), which adds up to roughly 1% to 6% of the fund’s total revenue.

This means that even with a productivity boost of 100% (2x efficiency gain), you’d be looking at delivering a mere 2-4% cost savings (as % of total revenue) - this assumes FTE reduction (i.e. funds will not be able to do 2x more deals).

Of course, the numbers might look different for smaller funds, where junior overhead makes up a higher % of the overall topline. But this comes at a cost - these customers will drive much smaller average contract values, making the TAM / total revenue opportunity even less attractive. Hard to make a case for a VC-scale business here.

PE is not very cost sensitive

Beyond the relatively ‘marginal’ cost savings, PE firms are not very cost sensitive to begin with! There is a reason why they do not outsource all of their workflows to a low-cost center in India (even though they DO have access to them) - they are OK paying $350K to Emily in NYC, knowing she’ll do the task at hand correctly, and quickly. Clearly, they value accuracy and trust much more than pure costs. So whatever marginal productivity gains a new startup COULD deliver to these firms will be weighed against a whole host of risks - data, privacy, accuracy, etc.

The (very real) threat from incumbents

The playing field is further complicated by incumbents who are well positioned to incorporate AI into their offerings. For instance, data room providers are already integrating "AI-enabled search" into their platforms. Moreover, expansive tools like Microsoft Copilot can leverage an entire firm's knowledge graph to streamline tasks like locating files or drafting memos (of note, Microsoft will charge $30/mo for this).

These startups are, therefore, grappling not only for their target customers' attention but also against titans with an established customer base and data access that startups might struggle to attain.

The Real Opportunity: AI for PE’s Portfolios

In my discussions with over 50 investors across large and mid-market funds, the consensus is that the most substantial opportunity lies in enhancing portfolio value through AI-driven efficiencies. Some examples include:

Improved analytics to identify trends and operational improvement opportunities.

Automate/augment sourcing and diligence of tuck-in M&A opportunities

Workflow automation at the portco level to reduce or reorient Full-Time Employee (FTE) hours towards more value-adding tasks.

Even a modest 5-10% efficiency gain (in terms of EBITDA) at the portfolio level would have an outsized impact on the fund’s total profits (multiples more than the cost savings from increased productivity at the junior level!):

Of course, building a tool that can achieve these things is not simple - not the least because every sector has their own intricacies and nuances. But the opportunity could warrant a vertical tool. Perhaps, the customer here is not even the private equity firm, but all SMBs in the XYZ industry, and a PE firm would just be a clever customer acquisition channel - if the fund likes your tool, they can integrate it across their entire portfolio, onboarding 10-15 customers in one sweep.

Conclusion

While I firmly believe that AI will permeate all knowledge-worker domains, including private equity, I contend that the market for a PE-specific automation tool isn't as lucrative as current startup activity suggests. There might be slivers of opportunity here and there, but I question the size of that market (both in terms of % of the job that is automatable, willingness to adopt these tools, and how much one could charge for them). Further, incumbent tools are likely to meet most of the “basic” needs of PE investors, leaving limited room for new startups to add meaningful value.

The more potent opportunity, in my opinion, lies in driving operational efficiencies at the portco level through workflow automation and improved analytics. This has the potential to unlock outsize value for the PE firm's top line—a prospect that is bound to capture their interest.

As always, all thoughts / pushback welcome. If you are tinkering in AI applications to the financial workflows, please reach out - I love jamming about this stuff and would love to compare notes.

DMs always open @leveredvlad

If you enjoyed reading this, subscribe to my newsletter! I regularly write essays about AI, crypto, and other cutting-edge technology.

Great read Ori! Curious what your thoughts are on opportunities opportunities when it comes to helping firms increase efficiencies around LP acquisition and helping firms increase AUM e.g) deal and relationship management software.

Would love to talk Ori - am @gm_mertd at Twitter