Compounding OffDeal

Or, how to 1,000x an AI-first investment bank

Welcome to Fully Distributed, a newsletter about AI and its impact on business. Join our growing community by subscribing here:

I’ve been obsessed with the framework from Ramp’s CEO, Eric Glyman, where he distilled their entire business into one equation. Once he had it, he could model which variable actually moved the needle. It turned out to be purchase volume. So, he pointed the whole company at that.

I wanted to do the same for OffDeal.

Most people assume that service businesses, especially “high touch” ones like investment banking, are unscalable. They’re seen as “black boxes” where revenue is just a function of deep relationships and bespoke financial advice.

We take the other side: we believe investment banking is a system that can be deconstructed, measured, and optimized - and software engineers are uniquely positioned to do this exceptionally well.

Deconstructing the Bank

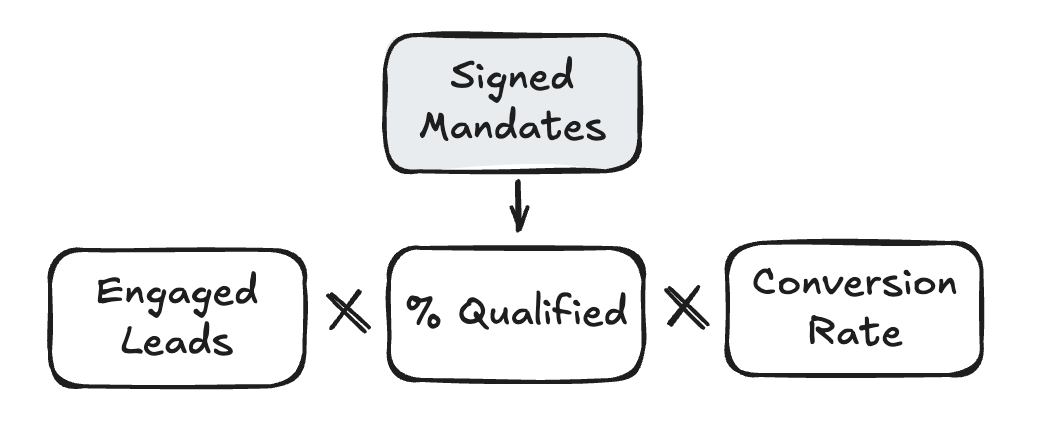

At the highest level, our business is simple:

But that’s not very useful. It masks all the variables that matter. So, let’s “double-click” on the components to find the real levers.

Total Deals Closed formula is pretty straightforward:

But where do Total Mandates Signed come from? Our origination funnel.

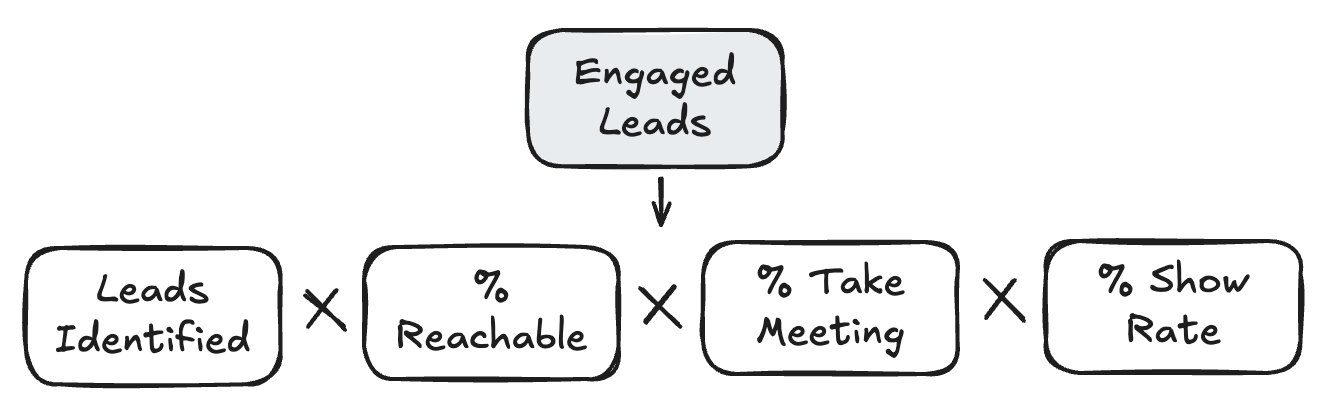

But wait! Where do our Engaged Leads come from?

Even Leads Identified can be further broken down into (Total TAM) x (% Identifiable).

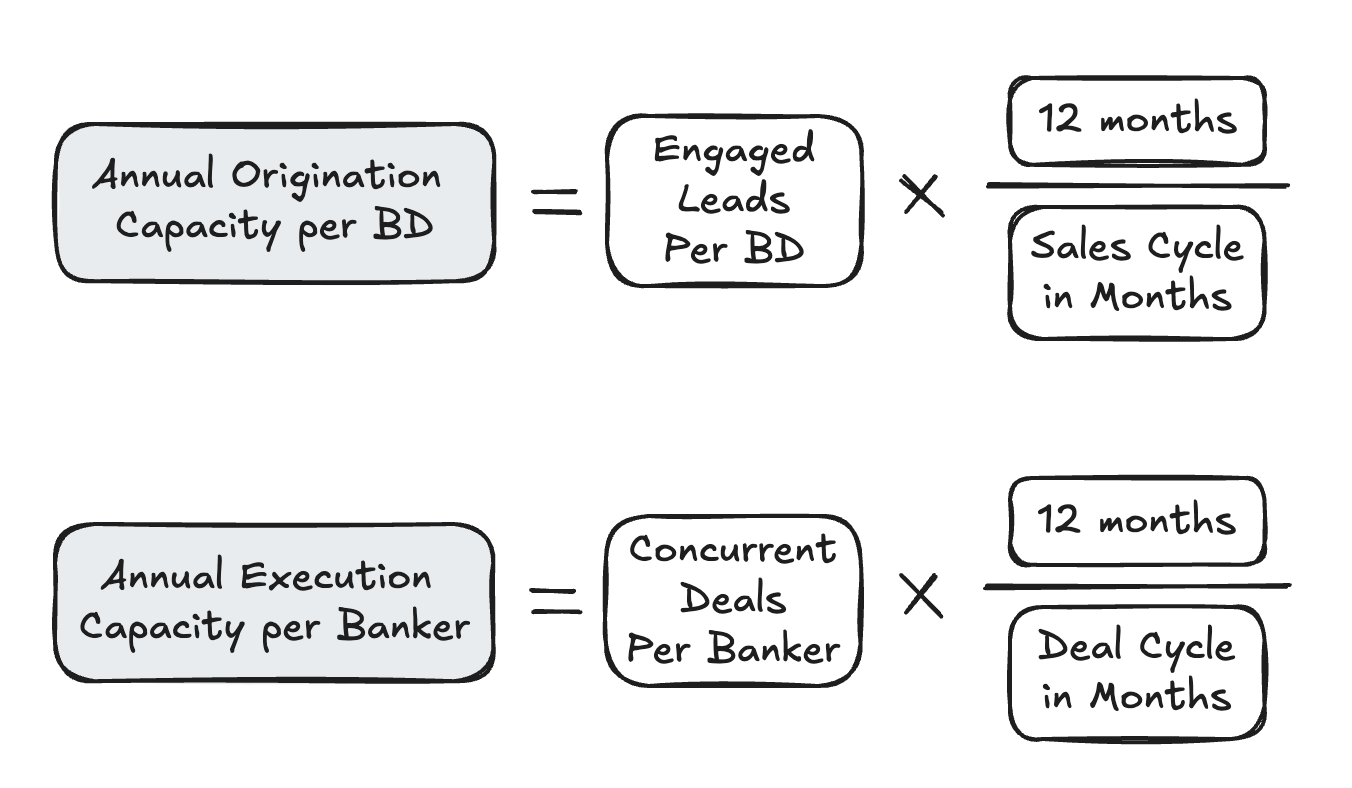

We can also use the same approach to deconstruct the system’s throughput as well:

The point is, you can do this for every part of the business. This allows you to trace exactly how a tiny 5% improvement in a given variable ripples all the way up to Annual Revenue.

Finding the 10x Levers

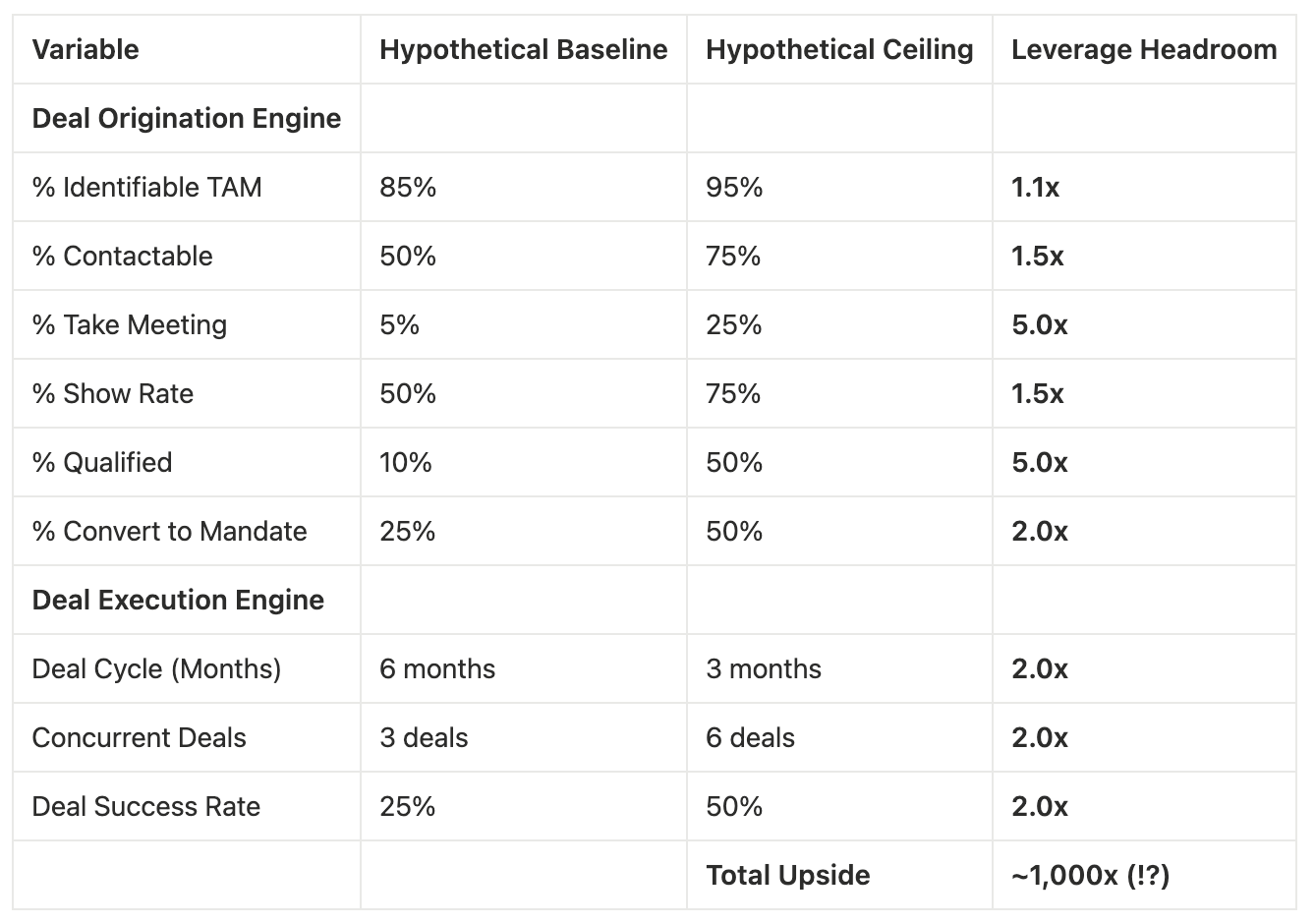

Just having this map isn’t enough. It tells us what the variables are, but not which ones to focus on. To do that, we analyze the “Leverage Headroom” for each one.

For every metric in our system, we ask:

What is our Baseline (e.g., 50% Show Rate)?

What is the Practical Ceiling (e.g., 80% Show Rate)?

The gap between them shows the total leverage up for grabs. This simple analysis immediately shows us where the 10x opportunities are hiding.

For example:

If our Show Rate is 50%, the absolute maximum we can improve is 2x (to 100%). The practical ceiling is even lower, maybe 1.5x (75%).

But if our % Qualified (leads that actually match our ICP) is only 10%, we have a theoretical 10x (100%) of headroom to work with.

In this instance, this analysis tells us that building AI to find better-qualified leads (a 10x problem) is a far higher-impact use of resources than just optimizing reminder emails (a 1.5x problem).

Our Optimization Blueprint

When we put this all together, we get a blueprint for the entire business - a robust framework to align on internal prioritization and where to deploy engineering resources. This table shows an illustrative example of how we view our optimization stack.

While these specific numbers are illustrative, our systems thinking approach illustrates a few key points:

Technology drives a powerful compounding effect. Improvements aren’t just additive; they multiply. A 2x improvement in Deal Cycle time and a 2x improvement in Deal Success Rate don’t just add up - they result in a 4x gain for the overall system. This is how you find 10x gains - by stacking multiple 2x and 3x levers.

Systems thinking enables ruthless prioritization. To be sure - we will work really hard on improving all of those variables. But practically speaking, as a resource-constrained startup, we need to deploy resources into the higher ROI projects. Our approach allows us to make calculated, data-backed bets on which engineering project will drive the highest impact.

This is all possible before traditional scaling. All of this leverage is unlocked without hiring a single extra banker or chasing bigger deals. These variables improve the engine itself.

In closing...

These are just a subset of variables, of course - we can do this mapping exercise across every single performance driver. These advantages compound very quickly.

It’s been so fun (though admittedly, hard) building out OffDeal. We see so much potential and have already realized insane productivity gains - all from allowing our engineers to re-architect every investment banking workflow from first principles.

If building applied AI solutions to real-world problems sounds interesting to you, we’d love to hear from you - we’re always hiring talented engineers to help us build the future of finance.

Send me a DM if you’d like to jam!

Ori Eldarov

As always, pushback and feedback always welcome. Twitter DMs always open @leveredvlad

If you enjoyed reading this, subscribe to my newsletter! I regularly write essays about AI and business.