STEPN: Crypto's Billion Dollar Fitness Opportunity

Or, How Move-to-Earn Model Could Make STEPN the Axie Infinity of Fitness

Welcome to Fully Distributed, a newsletter about some of crypto’s most exciting projects, business models, and tokenomics!

Join our growing community by subscribing here:

STEPN is easily one of the most innovative and exciting crypto-enabled games I have come across in quite a while. At its core, STEPN is a Web 3.0 “Move-To-Earn” fitness game built on the Solana blockchain (low fees!) in which users can earn a daily income through regular exercise. To facilitate this, the game rewards users with the game’s native currency - Green Satoshi Token (GST) for physically moving outdoors (walking, jogging, or running). At the time of writing, STEPN users are earning upwards of hundreds of dollars per day from their daily activities!

STEPN, who has recently raised a seed round from the likes of Sequoia and Alameda Research, aims to leverage token incentives to achieve its stated grand vision of:

Motivating millions of people to live a healthier and more active lifestyle

Onboarding people onto Web3

Combating climate change (by spending % of profits on carbon offsets)

But who’s actually paying for all these rewards? Does it have a sustainable business model? Can STEPN replicate the blockbuster success of other Play-to-Earn games such as Axie Infinity? In this essay, I will do a deep dive into STEPN’s gameplay, token mechanics and business model, as well as provide my views on why I think STEPN could become the next billion dollar crypto economy.

In particular, I will cover the following topics:

Gameplay (how do you actually play this game and earn money?)

Business Model & Tokenomics (does it make sense and is it sustainable?)

Investment Case (can this be a multibillion dollar opportunity?)

Conclusion (what’s the verdict?)

Let’s get to it!

Note: While the game has a lot of nuance and functionality, this essay will focus only on the most important gameplay mechanics and value drivers. For a more detailed breakdown of all the bells and whistles I recommend checking out the app’s whitepaper.

Gameplay

To get started with STEPN, a new user must go through the following onboarding process:

Download the STEPN app from the App Store and create an account

Transfer Solana (SOL) tokens into your in-game wallet (for example from Coinbase or MetaMask)

Purchase at least one NFT Sneaker (more on this later) from the in-app marketplace

Start exercising to earn rewards in native GST currency

Reinvest earnings into making new shoes or upgrading existing shoes, or swap GST into fiat and cash out

Let’s start with a few basic concepts of the game:

Each user is required to purchase at least 1 Sneaker to participate in the move2earn. Each Sneaker is unique (i.e. non-fungible) and has 4 attributes (Efficiency, Resilience, Comfort, Luck), all of which directly impact its earning potential.

Sneaker earning power can be boosted through upgrades (“level ups”). All Sneakers start out at Level 0 and can be upgraded all the way to Level 30, with each additional upgrade costing progressively higher amounts of GST. These upgrades permanently “burn” (destroy) GST out of total token circulation.

Level 0 shoes start at an earning cap of 5 GST per day, with a max daily earning cap of 300 GST per user

Sneakers come in many different types (each with their own optimal speed for maximum earnings) and qualities (with different rarities and min/max attributes).

Importantly, STEPN does not sell any of the shoes itself - users can only buy them from other users through the in-app marketplace, with the current floor price priced at ~7.5 SOL (STEPN will soon introduce peer-to-peer “renting” option to remove the upfront capital requirement and lower user onboarding friction). The game launched with an initial supply of 10,000 sneakers, and the total number of shoes in circulation can only be increased by “breeding” (minting) new shoes from any two existing shoes that reach Level 5 or higher. Each shoe can be used for breeding for a total of 7 times, with each consequent breed requiring higher and higher amounts of GST to be “burned” (starting at 200 GST). This means that for total supply of shoes to increase, sneaker floor price has to exceed the breeding cost.

Each new user starts with 10 minutes of revenue generating gameplay (denominated in “Energy”, with 1 Energy = 5 minutes of move2earn time). Once user’s Energy is fully depleted it will be replenished at a rate of 25% for every 6 hours (e.g. full day to get back to 100%). The only way to increase user’s Energy capacity (and therefore move2earn time) is to have more shoes in your portfolio (either by buying or minting new shoes), with a maximum cap of 100 minutes of continuous move2earn time.

In total, there are 3 primary sources of income available for STEPN’s users:

Generate GST rewards through daily exercise

Breed and sell new shoes on the in-app marketplace

Stake GMT (governance token) and accrue a portion of the game’s profits (I will explain this in more detail in the “Business Model” section)

For illustrative purposes, I provide below a simplified calculation of potential returns a STEPN user can expect to earn (as of this writing) under the 1st strategy using Joggers. In this example, a user with 9 sneakers can earn ~$85 a day for 45 minutes of moving activity at optimal speed, implying a ~480% annual ROI!

As explained earlier, users can further enhance these (already attractive) returns by leveling up their shoes (and increasing their Efficiency attributes), using a different type of shoe (Runner or Trainer), or using a higher quality shoe (with higher maximum attributes).

To state the obvious, these returns are highly dependent on the price the price of Sneakers and the GST token itself. This brings up three very important questions:

Who is paying all these rewards to users?

What determines GST price?

How does STEPN generate revenue?

Let’s dive in.

Business Model & Tokenomics

STEPN’s business model and tokenomics are very similar to that of Axie Infinity, the first play-to-earn breakthrough game that reached massive scale with millions of daily active users and billions in generated revenue. But how exactly does it work?

GST

At the moment, GST is the only native in token available within the game, and it most closely resembles Axie Infinity’s in-game currency SLP. It has an uncapped total token supply (currently ~280k tokens outstanding implying a market cap of $0.7m) and is used as a medium of exchange to pay out user rewards (resulting in new token issuance / inflation) and to breed (mint) or upgrade shoes (resulting in token burn / deflation).

Given that total shoe supply can only be increased via breeding, as the user base goes through its initial high growth phase, most of all new GST token issuance will be absorbed (offset) by the new token burn from creating new shoes (and to a lesser extent from upgrading/repairing existing shoes). When user growth eventually declines (whenever that is), the demand for new sneakers will gradually diminish, removing the deflationary pressure on GST supply, therefore making it increasingly inflationary over time.

While total rewards to users may stay relatively flat for quite some time (declining token price can be offset by higher token rewards per shoe), token inflation will accelerate over time resulting in net declining total rewards. To avoid hyperinflation management will have to balance new user growth with the magnitude of token rewards, and introduce new fun and clever burning mechanisms or adjust its in-game monetary policy. For now, the game’s primary burning mechanisms include shoe breeding, upgrades, and recurring shoe repairs (to offset “wear and tear”). Given the exponential growth in new users, these burning mechanisms will provide ample runway (i.e. keep inflation manageable) for STEPN team to figure out new use cases for its GST token.

Of note, this is exactly what happened to Axie Infinity’s SLP token. Over time SLP price has declined some ~90% from its all-time highs as its circulating supply has gone from 500 million to ~5 billion. Last week Axie team announced a 50%+ cut in SLP emission profile to combat the hyperinflation within its in-game economy.

Importantly, GST does not provide any value capture or governance to its token holders - it is merely a form of liquidity within the app to facilitate transactions.

Enter GMT.

GMT

GMT will be STEPN’s governance token and the primary mechanism for value capture within STEPN’s business model. This token is most similar to Axie Infinity’s AXS governance token. GMT token is not yet available, but will be launched once STEPN reaches sufficient scale.

As previously mentioned, unlike traditional games, STEPN does not sell anything to its users - all economic activity is done entirely peer-to-peer. Instead, STEPN’s revenues are derived from a small take rate (”tax”) that is applied on shoe-minting, shoe-trading, and shoe-rentals (when available). This tax will range 4-8% (depending on type of activity) and is very similar to the take rate of Axie Infinity, which charges 4.25% on all transactions within its game. Of note, vast majority of Axie’s revenue stream is derived from “breeding fees”, which is highly dependent on new user growth (since new Axies are needed to participate in the game). As such, I expect STEPN’s revenue in its early stages to be highly levered to user growth. As the user base matures, the mix of revenues will shift towards rentals and marketplace activity.

A small portion of the revenues will be used to cover STEPN’s overhead/operating costs, and the vast majority will be allocated towards dividend distribution to staked GMT token holders and carbon offset (holders can choose their allocation between the two). Staking (”locking”) GMT for longer periods of time will also increase the holders’ voting rights on future governance proposals.

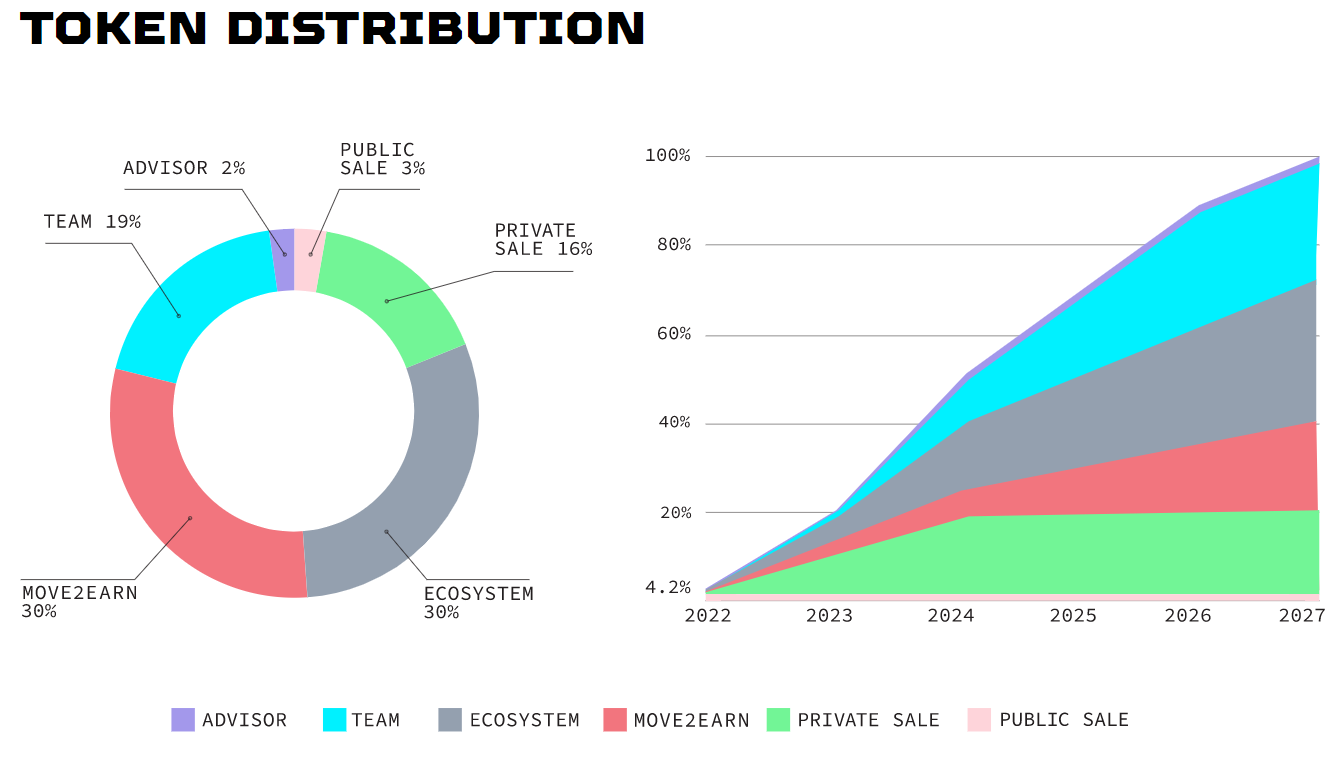

GMT will have a fixed supply of 6 billion tokens, of which 30% will be released as in-game rewards (alongside GST) over many years subject to a predetermined schedule. Importantly, STEPN’s team will own 19% of total supply which will also be released gradually overtime, ensuring that the team’s incentives are aligned with the game’s long-term success.

GMT will also double as a utility token (similar to GST) and will be used (burned) in shoe-minting, shoe upgrades/customization, as well as governance participation, driving in-game demand for the token.

Of note, Sneakers are currently priced in SOL. I expect STEPN to switch to GMT-based pricing once the token becomes available (similar to how Axie Infinity prices its NFTs in AXS). This will create additional demand for GMT token as new users enter the game and buy or rent their first sneaker(s), linking the demand for new Sneakers with the demand for GMT. Management may also introduce additional burning mechanisms for GMT, such as requiring a portion of GMT to be burned (in addition to GST) when minting new shoes or leveling up.

Investing in STEPN - Is It The Next Axie Infinity?

Now that we understand the basic gameplay as well as the game’s business model, the main question remains - can STEPN be a good investment and where will most of the value upside be?

Before getting into any of the numbers, it is important to note that for any game to have any chance of long-term success it must be fun for its users. Having used the app myself for the last week, I can vouch that it is indeed super addicting to watch your exercise rewards compound on a daily basis. And I’m not the only one - while STEPN is in its very early stage - its MAUs and DAUs stand at ~45k and ~15k respectively - it has been experiencing incredibly exponential growth. I expect this trend to continue and can definitely see a path for its user base to exceed 1 million over the next 12 months. (A quick note on TAM - Axie Infinity thinks of its TAM as people living in countries that earn less than $500 / month, which covers ~1.9 billion people globally. I think this is a helpful proxy for STEPN’s addressable market given similar economic incentives).

In addition, the game’s Discord community is filled with people sharing success stories about their fitness transformation or newly found passion for regular exercise. That is truly special and is indeed STEPN’s primary mission - to help people live a more active and healthy lifestyle! Beyond that, management has plans to introduce new features such as “Marathons”, “Leaderboards”, as well as various social functionalities (”SocialFi”). There are also interesting future partnership opportunities with sports brands (e.g. Nike, Adidas, etc), sporting events (various running events), as well as opportunity to expand into other sports (e.g. cycling) or adding new metrics (calories burned, heart rate, etc). Longer-term, STEPN can introduce User Generated Content, enabling users to create their own games on top of STEPN which would drive sustainable demand for GST token. Bottom line is that I have confidence in the team’s ability to keep its users engaged and active on the app for years to come.

With that... let’s talk some numbers.

One can invest in STEPN in 3 main ways:

Buy GST

Buy GMT (under development)

Buy NFT Sneakers

As mentioned earlier, GST is mostly just a medium of exchange within the game, and will have an increasingly inflationary token supply profile over time for two main reasons:

When user growth eventually slows, there will be less and less demand for new shoes → less and less new shoes minted → less and less GST burned → less deflation

As users upgrade their shoes to higher and higher levels, each shoe will be generating more and more token rewards → more and more new GST issued → more inflation

As such, I do not expect material price appreciation in the GST token.

In contrast, GMT will have a fixed token supply (6 billion), and will accrue profits generated by the in-game economic activity (via taxation). I expect the demand for GMT to remain high due to:

New users entering the STEPN ecosystem → higher economic activity → higher profits generated by the protocol and

Once Sneakers are denominated in GMT → new user growth → higher demand for new Sneakers → higher demand for GMT

I view GMT’s value capture mechanism as very sound, and expect significant upside as STEPN’s user base gets bigger and bigger. As a proxy, Axie Infinity reached ~2 million active users, resulting in billions of dollars of in-game economic activity, pushing AXS market cap to ~$4 billion (and that’s after a 2/3 price correction!). I can see similar upside in GMT token and will be buying it... when it becomes available.

NFT Sneakers are the last major way in which investors can participate in STEPN’s success today. In absence of an investable GMT token, I view this as the second best alternative for investing in STEPN. At current floor prices of ~7.5 SOL (or $750), token rewards from exercise imply annual yields of 300-600%+ (at a minimum, since I used Level 0 shoes in my analysis). These are highly attractive and I expect these to compress further. Moreover, given rapidly increasing user base, I believe demand for new shoes will outstrip shoe supply growth, putting additional upward pressure on floor prices.

Finally, as a helpful proxy, we can examine the price performance of Axie Infinity’s AXS and SLP tokens (equivalent to GMT and GST, respectively, below). As can be seen from the chart, AXS has appreciated ~39,000%, whereas SLP has declined ~-86%! It is clear that AXS has been a much better bet on Axie’s economy than SLP by a wide margin!

Finally, there are of course some risks involved. One is around user growth - while the protocol is growing very quickly, it is critical for STEPN to reach meaningful scale to generate sufficient economic activity. While a lot of the growth to date has been achieved organically through word of mouth (which is great!), the team has earmarked ~30% of its total token supply towards an Ecosystem Fund for various promotional and marketing programs.

Another major risk is around the sustainability of STEPN’s in-game crypto economy - management must find the right balance between user growth and token inflation - if GST supply enters hyperinflation, user rewards will decline significantly, negatively affecting earnings of existing users as well incentives for new users to join (resulting in a collapse of the economy). Managing any economy (even a virtual one) is very complex and the STEPN team will have to pay close attention to its monetary policy user metrics to make appropriate data-driven adjustments when necessary to incentivize the desired user behavior.

Conclusion

STEPN is no doubt one of the most innovative and exciting new projects in GameFi today. It has set out a beautiful mission to get people to exercise more, onboard people onto Web3, as well as lower our planet’s carbon footprint. I have strong confidence in the team’s ability to find ways to keep users engaged within its ecosystem, and I do not see a reason why its current daily user base of ~15,000 people cannot increase by orders of magnitude from here.

I believe that GMT could be a highly attractive investment when it becomes available given its sound value capture mechanism and fixed supply. If Axie Infinity’s success is any indication, STEPN has the potential to attract millions of users and generate billions of dollars of in-game economic activity. Given how early-stage this project is today, I see very attractive risk-reward here.

On the other hand, I believe GST will experience increasingly high token inflation over time, and as such, do not see material upside long-term (even if in the short-term its price may pump due to market’s lack of understanding of the game’s token economics / lack of other investable tokens at the time). As such, I am not going to hold a meaningful GST position in my portfolio.

In the meantime, I have been accumulating NFT Sneakers as a bet on continued user growth and adoption. I see near- and medium- term upside in its floor price, underpinned by the attractive yields these Sneakers generate today, as well as growing demand for new Sneakers from new users. I will continue to harvest my GST rewards from my daily commutes and reinvest these earnings into buying/minting new Sneakers.

I fully appreciate that this project is in its infancy and that there is a significant risk of permanent capital loss, however, as both a fitness and crypto enthusiast, I am genuinely rooting for this project’s long-term success.

DYOR and invest at your own risk. NOT financial advice.

How did the initial supply of 10,000 sneakers were distributed? By internal sales?

As with any crypto project, its white paper can be confusing for the average investor and user. Your article condenses the key points and makes the case for STEPN crystal clear. Thank you for this analysis