UXD: The Perfect Stablecoin

Or, how an obscure yet innovative stablecoin will take the Solana ecosystem by storm

Welcome to Fully Distributed, a newsletter about some of crypto’s most exciting projects, business models, and tokenomics!

Join our growing community by subscribing here:

If you have used crypto, it is very likely that you have come across stablecoins - you know, those tokens that are always priced at $1.00? Perhaps you swapped dollars for USDC on Coinbase to send money to one of your wallets. Or maybe you deposited money into your Gemini account and converted it into GUSD to earn an 8.5% yield on your savings. Or maybe you paid for your online order with UST using the Chai app. Or did you receive a payment in USDT from overseas for that consulting project?

You might ask, why talk about stablecoins? Aren’t they… kinda boring?

No! Stablecoins have by far one of the largest TAMs in crypto (the $130 trillion global money supply itself). Indeed, stablecoins have already become ubiquitous within crypto. By the end of 2021, the combined stablecoin market cap reached an astonishing $180 billion (and still growing!). This should makes sense - as our lives (and economic interactions) become increasingly digital, we need the financial infrastructure to provide a stable medium of exchange to execute frictionless peer-to-peer transactions. Herein lies an opportunity - successful scalable stablecoin projects have the potential to generate massive upside for investors.

One such project is UXD Protocol - a new stablecoin on the Solana network that is backed by a stable of industry veterans such as Multicoin Capital and Alameda Research. UXD aims to eliminate the tradeoffs that exist in incumbent stablecoin solutions today by offering a fully decentralized, capital efficient, and stable asset pegged to USD.

UXD Protocol caught my attention due to its incredibly elegant business model and clean tokenomics design. The more I dug into the project and its roadmap, the more impressed I became. I believe UXD has the potential to become a major player in the stablecoin arena, offering early investors an asymmetric risk/reward profile given the project’s early stage of development and user adoption.

In this essay I will cover the following topics:

Stablecoin 101 (what are they and why do we need them?)

UXD Business Model (how does UXD work and make money?)

Tokenomics & Valuation (is UXD an attractive investment?)

Conclusion (what’s the verdict?)

Let’s dive in!

Stablecoin 101

Stablecoins are blockchain-based versions of fiat currencies (such as USD or EUR) that offer price stability while still providing key crypto-native properties such as cheap and fast transaction settlement, 24/7/365 trading, privacy, and security.

Given that stablecoins are typically pegged to a fiat currency (e.g. 1 USD stablecoin = $1.00), they do not offer any price appreciation potential (unlike say Ethereum or Solana). Instead, they are primarily used as a price-stable unit of exchange within the crypto ecosystem, mitigating the price volatility seen in other crypto assets (which can move up or down in price 10%+ in a single day) . Some of its primary use cases include:

Peer-to-peer money transfers (especially cross border)

Purchases of goods and services (provides instant transaction settlement)

Buying/selling cryptocurrencies on trading platforms that do not offer a fiat on/off ramp

Borrowing / lending money via decentralized finance (DeFi) applications

Yield farming (providing liquidity on decentralized exchanges)

Stablecoins have seen a massive rise in popularity over the last year, following a cambrian explosion of app development within DeFi and the overall increase in peer-to-peer transaction activity on blockchain networks. As of this writing, the total market cap of all stablecoins is nearly $180 billion.

As can be seen from the chart above, stablecoins come in many different flavors, each employing different mechanisms to maintain the peg to the fiat currency. Let’s explore the three dominant stablecoin types and their respective drawbacks / risks.

Note: If you are already familiar with stablecoins, feel free to skip to the “UXD Business Model” section.

Fiat-backed stablecoins (e.g. USDT, USDC, BUSD). These stablecoins are backed 1:1 with off-chain USD reserves in traditional bank accounts. These reserves are custodied with centralized providers (e.g. Tether in the case of USDT or Binance in the case of BUSD). To date, this has been the biggest and most popular type of stablecoin by market cap. The biggest drawback of this solution is centralization, which results in three primary risks:

Trust - the user must trust that the custodian of the off-chain deposits actually has enough reserves to back every on-chain stablecoin, which typically requires an audit done on a regular basis by a 3rd party audit firm. The potential danger of such structure came to light when Tether found itself in hot waters when an allegation surfaced that it used $850m of Tether funds to cover a loss at the parent company.

Regulatory - Lack of clear regulatory framework around custody of reserves, as well as potential privacy / reporting concerns

Censorship - Risk of asset freezes / blacklisting by the custodian (Tether recently froze $160m worth of assets upon request of law authorities)

Crypto-backed stablecoins (e.g. DAI). To address the issue of centralization crypto-backed stablecoins rely on trustless/decentralized crypto assets such as Ethereum. The biggest issue with this design is that it is capital inefficient - given the significant price volatility of the underlying reserves crypto-backed stablecoins require overcollateralization - this means that every $1.00 of stablecoin has to be backed by 1.5-2.0x of collateral capital. Additionally, to grow the reserve base protocols such as MakerDAO (providers of DAI) began accepting non-decentralized assets such as USDC - injecting the very problem of centralization these protocols were meant to address in the first place!

Algorithmic stablecoins (e.g. UST, FRAX, FEI). Algorithmic stablecoins were created to address the shortcoming of the fiat-backed and crypto-backed stables. They are completely on-chain (i.e. trustless and decentralized), and are backed by no collateral (i.e. capital efficient). Instead, to maintain its peg to USD these coins rely on some sort of algorithmic rebalancing of supply and demand of the stablecoin. In the case of Terra’s UST (biggest algo stablecoin at the time of writing), the peg is achieved through an algorithmic incentive mechanism. At any time, users on Terra can burn $1 of LUNA to mint 1 UST, or burn 1 UST to redeem $1 worth of LUNA. Here’s an example:

If UST price increases to $1.05, traders can burn $1.00 of LUNA (Terra’s native token) in exchange for minting 1 UST, generating a $0.05 risk-free profit. This would reduce LUNA supply and increase UST supply.

If UST price drops to $0.95, traders can burn 1 UST in exchange for minting $1.00 of LUNA, once again, generating a risk-free profit of $0.05. This would reduce UST supply and increase LUNA supply.

While UST’s market cap has ballooned to $14 trillion, much of its popularity has been driven by an incredibly high 19.5% yield it offers its holders via Terra’s DeFi app Anchor. To maintain such a high APY, Terra's parent Terraform Labs recently had to replenish the yield reserve. If the yield reserves do ever run out, the APY on UST will likely be <10%. If this occurs, the demand for UST might significantly diminish, causing investors to migrate funds to other protocols, thereby drying up UST liquidity and introducing de-pegging risk, which has raised concerns around the long term stability of the UST peg.

Stablecoin Trilemma

To summarize, for a stablecoin to be an effective proxy for digital cash, it must possess the following three properties:

Decentralized & trustless - fiat-backed stables such as USDC and USDT are capital-efficient and relatively stable, but are governed by centralized entities that store its reserves in off-chain traditional bank accounts, introducing a single point of failure risk (trust, censorship, fraud)

Capital efficient - crypto-backed stables such as DAI require 1.5-2.0x as much capital as the amount of stablecoin it produces making it highly inefficient

Price Stable - it must maintain a tight peg to the underlying fiat currency even in times of significant market volatility. Algorithmic stables such as UST, FRAX or FEI all rely on multi-token rebalancing mechanisms that introduce a lot of reflexivity and a risk of a potential de-pegging.

Until recently, no existing stablecoin possessed all three of those properties.

Enter UXD.

UXD Business Model

UXD is a new stablecoin on the Solana network that aims to maintain a perfect peg to the USD. The UXD Protocol operates as follows:

User deposits $100 of crypto collateral (e.g. ETH, BTC, or SOL) and receives 100 newly minted UXD tokens (1 UXD = $1.00 USD)

The protocol immediately shorts the equivalent amount of collateral to achieve a perfectly hedged position. This means that if ETH drops/increases in price by 10%, the short position would fully offset that price change, resulting in no change in the value of the underlying collateral base.

UXD relies on arbitrageurs to maintain a perfect peg to the USD. For example, if UXD trades at $1.05, users can deposit $1.00 of collateral to receive UXD. If UXD trades at $0.95, users can redeem each UXD for $1.00 of collateral. This means that whenever the price of UXD deviates from $1.00 traders will be able earn a risk-free profit by arbitraging the token back to the peg.

UXD’s elegant design is intended to address the shortcomings of existing stablecoins:

It is fully trustless and decentralized and is backed by on-chain deposits

It is capital efficient - each UXD is backed 1:1 by its reserves

It is price stable - UXD is insulated from market volatility given its perfectly hedged collateral nor does it depend on reflexive multi-token incentive mechanisms

However, to fully grasp UXD’s business model we need to add a bit more nuance around how the protocol actually works and how it generates revenue.

A Quick Detour - Perpetual Swaps 101

First, we must understand how exactly the protocol is able to “short” its collateral base to achieve a perfectly hedged market neutral exposure. UXD does so via perpetual swaps - a type of financial derivative. Without getting into too much technical detail, this instrument can be described as follows:

“Perpetual swap” contract is a way to gain exposure to an underlying asset without having to “settle” the asset at any point in time.

Each contract has two parties - a buyer (“long” position) and a seller (“short” position). Contract price may be higher or lower than the spot price of the underlying asset, which would require either the buyer or the seller to make a payment to the counterparty to compensate for the difference:

An important takeaway here is that in bullish markets the funding rate is typically positive - the “short” position receives a payment from the “long”, while in bearish markets the funding rate is typically negative - the “short” makes a payment to the “long”. This should be intuitive - the funding rate acts as an incentive to enter the other side of the trade: the more bullish the market → the higher the difference between contract and spot price → the higher the funding payment an investor receives for entering a short position. This is exactly why funding rates typically oscillate between positive and negative, depending on underlying market conditions.

Ok, let’s get back to UXD.

UXD Revenue Model

Ok quick recap.

Every UXD token is backed by $1 of cryptocurrency collateral.

The protocol eliminates all market price exposure by “shorting” its collateral reserves via perpetual swap contracts.

Depending on market conditions, the protocol will either receive payments from its swap position (when funding rate is positive) or make payments (when funding rate is negative).

As demand for UXD stablecoin grows over time, so will the protocol’s deposit base, or “total value locked” (given that each UXD is backed 1:1), as well as its swap positions. Therefore, UXD’s gross revenue model can be distilled into the following formula:

Revenue = Total Value Locked x Funding Rate, where

Total Value Locked = UXD Market Cap

This simple revenue model invites two important questions:

How big can UXD deposits get? (i.e. what is the TAM?)

What would a long-term funding rate look like? (i.e. what are the unit economics?)

Let’s tackle TAM first.

A Multi-Trillion Dollar Market Opportunity

At its core, stablecoins attempt to provide a digital-native equivalent of cash. Critically, stablecoin use cases extend far beyond that of just crypto - in the future we will be using this digital infrastructure to facilitate frictionless peer-to-peer transactions, as well as to pay for goods and services. This means that the total TAM for stablecoins is the global money supply itself - about $130 trillion. As such, I expect the demand for stablecoins to grow exponentially over the next decade (B2B payments sector represents a $35 trillion opportunity alone).

UXD is committed to providing a trustless, decentralized solution backed by on-chain crypto collateral. Therefore, a bet on UXD Protocol is a bet on both growing UXD adoption as well as on the growth of the overall crypto market cap (currently at $2 trillion vs ~$475 trillion of all global assets).

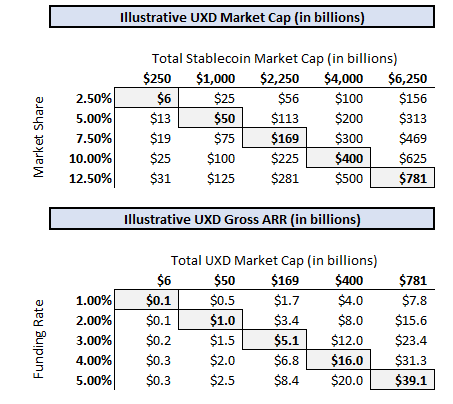

Today, the combined stablecoin market cap sits at ~$180 billion, or 9% of total crypto market cap of ~$2 trillion. For illustrative purposes, I provide what total stablecoin market cap could look like for a given size of the overall crypto market and a stablecoin market share:

As can be seen from the above example, it is not unimaginable that the total stablecoin supply will be in the trillion of dollars, and while we can’t tell for certain how much UXD will be able to capture, the total opportunity is clearly massive.

Attractive, but Volatile Unit Economics

The other key value driver for UXD is the realized funding rate, which determines how much revenue the protocol can generate on each dollar of its deposit base.

As explained earlier, funding rate can be either positive or negative, depending on market conditions. Although the funding rate on BTC and ETH swaps has typically been positive (which means swap buyers pay swap sellers), it’s also been incredibly volatile. However, as crypto markets have significantly matured over the past few years (both in terms of market cap and liquidity), the funding rate volatility has reduced substantially.

Assuming crypto will continue to experience exponential growth for years to come, the funding rate is likely to remain largely positive somewhere in the 1-5% range (annualized). Applying these rates to a range of potential UXD market cap outcomes illustrates just how profitable the protocol can become in the future:

With that said, it is clear that there will be periods of time with negative funding rates, requiring UXD to make payments to the buyers of the swaps, which could result in prolonged cash outflows.

To mitigate this risk, UXD has set up an “insurance fund” (initially funded with $57 million from the UXP token sale) to create a buffer against sustained periods of negative funding rates. At the moment, 100% of protocol’s revenues are allocated to the insurance fund. In the future, UXP tokenholders will be able to vote on how the gross revenues generated by the protocol will be allocated between the insurance fund and profit distributions.

Now that we covered UXD’s business model and key value drivers, let’s bring it all together by looking at the protocol’s tokenomics & valuation.

Tokenomics & Valuation

UXP is the native governance token of the UXD Protocol. It has a fixed total supply of 10 billion tokens with a multi-year emission schedule. The UXP token serves three primary function:

Governance decisions

Liquidity provider of last resort (should insurance fund get depleted)

Profit distribution to staked UXP tokenholders (subject to voting)

UXD Protocol’s “profit” can be viewed as whatever is left over after funding the insurance fund and covering overhead. While actual profit distributions are subject to a governance vote, this analysis assumes an illustrative 50% profit share.

Overall, there are three primary ways to earn a return via UXD Protocol:

provide liquidity for UXD tokens and earn an APY

provide liquidity for UXP token and earn an APY

stake UXP and earn protocol’s distributable profits (subject to vote)

So is investing in UXP attractive at current prices?

Valuation

Given how new and unique this protocol is, finding relevant comparables is next to impossible. Equally, given a very limited track record, forecasting the protocol’s future growth is just as tricky. With that in mind, and based on some of the TAM analysis presented above, I ended up evaluating three illustrative growth scenarios:

Base Case = ~$140bn TVL by 2031, LT funding rate of 3.0%, 70% probability

Downside Case = $6bn TVL by 2031, LT funding rate of 1.0%, 20% probability

Upside Case = $410bn TVL by 2031, LT funding rate of 5.0%, 20% probability

Summary of the key operating assumptions for each scenario can be found below:

You can find my model here if you’d like to play around with your own numbers.

Using a Discounted Cash Flow (DCF) analysis and a target 25% IRR I derived a blended valuation of ~$0.38 (on a fully diluted basis), implying a ~6.6x upside from current price of $0.058. In the upside case, this analysis implies a ~21x return from current levels. Therefore, I see the risk/reward here skewed asymmetrically to the upside, and as such I view UXP as a very attractive investment at current levels.

Note: At the risk of sounding redundant, given how nascent this business is, this valuation framework is highly sensitive to assumptions on TVL growth as well as long term funding rates

Key Catalysts

On a more qualitative side, this is the perfect time for UXD to launch its product. More specifically, I see the following near to medium term catalysts driving the protocol’s growth and adoption:

Robust product roadmap for 2022 - UXD team looking to add UXP staking functionality, integrate cross-chain capability, as well as introduce other fiat currencies such as JPY, EURO, GBP. All of these updates should drive meaningful demand for both UXD and UXP tokens.

UXD’s native blockchain, Solana, is rapidly expanding with hundreds of new DeFi, NFT, and Gaming projects launching over the coming months. A Solana-native stablecoin will find an easy product-market-fit.

Given the global geopolitical tensions and associated recent asset seizures/freezes by governments around the world has brought back its focus on the notions of “self-sovereignty” and decentralization. Demand for censorship-resistant and trustless financial products will only keep getting bigger.

Recent spike in volatility is driving investors into price-stable “risk off” assets which should be bullish for near-term demand for stablecoins, and particularly those that are insulated from market fluctuations.

Long-term secular tailwind of growing broader crypto adoption across numerous verticals and industries should continue to drive peer-to-peer transaction growth and, in turn, increased demand for stablecoins.

Key Risks

While I genuinely believe in the protocol’s high growth potential, I would be remiss if I didn’t mention a few potential risks associated with this protocol and its future development:

Funding rate risk - funding rates have been quite volatile in the past and it is anyone’s guess where they will settle long term. Given that funding rates are the primary revenue driver for UXD, a low/near-zero funding rate will materially reduce the protocol’s profitability.

Liquidity constraints - UXD currently relies on on-chain perpetual swaps on Mango Markets (Solana’s native perp market). New UXD can only be minted if there is sufficient liquidity in the perp market to enter into offsetting short positions. Given relative immaturity of on-chain perp markets on Solana network (measured in the 10s of millions USD vs off-chain markets measured in the 10s of billions USD), lack of liquidity could potentially significantly constrain UXD’s supply growth. To mitigate this, UXD accepts multiple types of collateral (ETH, BTC, SOL to start), increasing total available liquidity. It is also worth noting that liquidity on Mango Markets has been steadily rising and is expected to continue to do so in tandem with continued growth of Solana ecosystem and broader crypto market.

Regulatory issues - given that UXD peg relies on hedging via perpetual swaps, UXD Protocol is currently not available in some key geographies such as United States due to regulatory issues. This lack of access could potentially slow down the adoption / supply growth of UXD. Management said they are working with counsel on potential workarounds. Of note, all users can still buy UXD or UXP tokens on the open market - it is only the minting/ redemption of UXD that is unavailable in certain geographies.

Insolvency risk - whenever funding rates are negative, the protocol has to pay out money to the “long” counterparty of the swap. If funding rates stay negative for a prolonged period of time there is a risk of insurance fund depletion, which would trigger the protocol to issue new UXP tokens (diluting existing holders) to fund the cash shortfall. Of note, UXD’s current insurance fund could sustain ~12 months of negative 10%+ funding rates at $500 million TVL. UXD published a detailed study on impact of changes in funding rate on protocol solvency.

Smart contract risk - this is true for any on-chain protocol, but is particularly true for newer, less mature projects. UXD smart contracts have been audited by two independent smart contract auditors and no major issues were identified.

Conclusion

UXD Protocol is a very ambitious and innovative product designed specifically to solve the so called stablecoin trilemma. I believe its censorship-resistant and capital efficient solution will find a natural product-market-fit within the burgeoning Solana ecosystem, driving significant demand for UXD.

This project is still relatively under the radar (only $21 million of TVL!) and I see asymmetric risk/reward at this stage of its development. I have been and will continue to invest at these levels.

With that said, it is very important to keep in mind a number of key risks involved such as potentially volatile unit economics (funding rate), as well as potential growth constraints (limited on-chain perp markets, not available in some countries such as the US due to regulatory issues).

As always, this is definitely NOT financial advice - this thing could moon or go to zero. Always DYOR and only invest what you can afford to lose.

Thanks again for another great analysis, Ori :-)

Excellent breakdown Ori.