Ethereum Tokenomics: Powerful Flywheel or Cycle of Doom?

On Ethereum token incentives, value capture, and the network's future.

Ethereum is the 2nd biggest crypto network by market cap ($360bn at the time of writing) and is the most well known cryptocurrency after Bitcoin. Yet, despite its size and popularity, relatively few people understand how value actually accrues to ETH token holders, and in turn, how to calculate the value of the asset.

One valuation approach that has been making its rounds through Crypto Twitter is a Discounted Cash Flow analysis that calculates the present value of future cash flows of the Ethereum network. While this clever approach may be attractive to people with TradFi backgrounds (i.e. recovering investment bankers like me!), I see a few key issues with this framework:

Network “revenues” do not accrue to all token holders (some are captured only by miners or stakers, while others - like the fee burn - are captured by all token holders)

It is inherently circular since network revenues are denominated in ETH, which is what the DCF is looking to value in the first place

It requires taking an arbitrary view on the transaction fee growth of the protocol for the next 10-20 years

It requires taking an arbitrary view on the appropriate discount rate to determine present value

In this piece, I take a deep dive into the token economics behind this project, explain the feedback loops that these incentives create, provide an alternative framework for Ethereum valuation and explain why I think Ethereum will be worth trillions of dollars over the coming years. In particular, I will cover the following topics:

Revenue Breakdown

Key stakeholders & Incentives

Ethereum’s Future

Risks

Let’s dive in.

Note: this essay assumes that the reader is already familiar with basic crypto concepts and terminology such as “Proof of Work” and “Proof of Stake”. For those that need a refresher I recommend skimming this and this before jumping into the rest of this piece.

Revenue Breakdown

To understand Ethereum’s economic model, we must first understand how the protocol generates its revenue. In 2021 the network generated a record $9.9bn, reaching $1.9bn in December 2021 alone, implying a whopping ARR of $22.8bn! (not bad for a protocol worth $360bn!).

Ethereum revenues are derived from transaction fees that are incurred by the users of the network and paid to the miners (under Proof-of-Work) or stakers (under Proof-of-Stake) for validating transactions and keeping the network secure (I will expand on this later). Under the current Proof of Work consensus mechanism, the fees are incurred at both the protocol-level and individual user level. Let’s explore these in more detail.

Protocol Level Fees

Under the Proof-of-Work consensus mechanism, miners are responsible for validating transactions and keeping the overall network secure from attacks. For doing so, they are compensated with a “subsidy”, which is awarded to them by issuing 2 brand new ETH tokens for every new validated block (in December 2021 alone miners earned $1.7bn this way!). It is critical to understand that while these fees are a primary revenue stream for the miners, they are ultimately an implicit cost of securing the network for all existing ETH token holders, who are diluted each time new tokens are added to the circulation. Think of it as if Apple was compensating its auditors by issuing them new AAPL shares - this would be a great deal for the auditors but would be dilutive to existing Apple shareholders!

Individual Level Fees

These fees, denominated in ETH, vary throughout the day based on the congestion of the network (e.g. demand for transaction validation) and are incurred by the users each time they want to execute a transaction. These consist of a Base Fee and a Tip:

Base Fee. Users are quoted a transaction cost which they can either accept or reject depending on how much they value their transaction to be executed (they can still rank their priority as low, medium, or high based on how urgent their transaction is). If the block is 100% full, this fee will increase 12.5%, if less than 50% full it will decrease 12.5%. Once transaction is executed, the base fee is burned (e.g. removed from token supply), which is deflationary to total ETH supply and can be thought of as a “refund” to all ETH holders (in TradFi this would be analogous to a share buy-back). This fee accounts for 70% of total transaction cost. In theory, the more transactions occur on the network, the more deflationary pressure this will have on total ETH supply. At current levels of activity, the network has already experienced several “net deflationary” days, in which the amount of ETH burned exceeded the amount of ETH issued to miners. At the time of writing, ~$6.5bn of ETH has been burned to date (since EIP-1559 came into effect in mid-2021).

The Tip (accounting for the remaining 30%) is currently paid to miners on top of the subsidy for validating and securing the network and can be thought of as a “priority fee”. Wallets will provide a suggested tip, but users can adjust this manually to move their transaction up or down in priority of validation.

As Ethereum prepares to transition to Proof-of-Stake mechanism (anticipated in H2/2022), the burden of validating and securing the network will shift to stakers (more on this later), who will earn a % of the newly minted ETH when it’s created + the “tip” explained above (Proof-of-Work miner rewards will be removed).

Key Stakeholders & Incentives

On the most basic level, there are 4 primary stakeholders participating in the Ethereum network. These are:

Miners (under Proof-of-Work mechanism)

Stakers (post transition to Proof-of-Stake mechanism)

Network users

Financial investors

Let’s briefly explore each of these stakeholders and their primary incentives. It is important to note that it is possible for an individual to have any and all of the above roles at any given moment (e.g. one can be a staker, a user, and a financial investor all at once).

Miners

In simple terms, miners are computers running software that process and validate all transactions on the network and protect it from attacks. They do so by solving computationally difficult hash puzzles to produce blocks, which requires significant computational power (and therefore energy). In return for validating the network (and incurring costs for doing so), Miners earn transaction fees.

While anyone can be a miner, not everyone can do so profitably. However, it is pretty straightforward to run an IRR analysis on the economics of a given mining project based on the following value drivers:

Revenue - subsidy reward + tip explained above

Variable cost - electricity, fees (if using cloud-mining or mining pool services)

Capex - high-end computers with powerful GPU, misc. equipment (ventilation, cooling, wiring, etc.)

Miners will try to minimize their costs by setting up operations in areas with cheap reliable electricity as well as by achieving economies of scale (get discounts on big equipment orders + procuring electricity wholesale).

A few important notes on this model:

Miners have no control of their top line, since transaction fees are a function of network congestion (the higher the usage the higher the fee in ETH) and ETH price itself. As such, mining revenue can differ quite a bit month-to-month.

The service miners provide (validation & security of network) is an undifferentiated and commoditized good, which means that there will always be downward pressure on profits as more miners enter the market. For example, solo mining and most cloud mining operations (after fees) are already not economical at the time of writing.

Miners need not be users of the network itself, and given the dynamics above, miners would typically immediately monetize all or most of the ETH they generate to cover their costs and realize a profit in USD. This provides constant sell pressure of newly issued ETH that needs to be absorbed by the market.

Miners’ key objective is to maximize profits from their mining operations. As such, they benefit from higher network activity (higher demand for block space results in higher tip + higher base fee burn), as well as higher ETH price (since all fees earned by miners are denominated in ETH but mining operating costs are denominated in fiat). Additionally, given the anticipated transition to Proof-of-Stake in the near-term (and the removal of mining rewards), miners have little incentive to invest in additional mining capacity moving forward. Since miners do not need to be invested in the network, they are typically incentivized to immediately monetize any ETH rewards they earn by selling them at spot price (creating a misalignment in long-term incentives between miners, users and investors).

Stakers

As a more elegant (and environmentally friendly) solution to network security, staking removes the need to run supercomputers to solve mathematical problems to validate transactions. Instead, it requires validators to “stake” or “lock” their ETH tokens (currently at 32 ETH per node) as collateral, which theoretically can be done on an everyday computer connected to the internet. These nodes are taken at random to create new blocks and validate the blocks they did not create and are rewarded with a percentage of newly minted ETH tokens for doing so. Validators may lose a portion of their collateral if they go offline (fail to validate) or lose the entire stake if they engage in collusion.

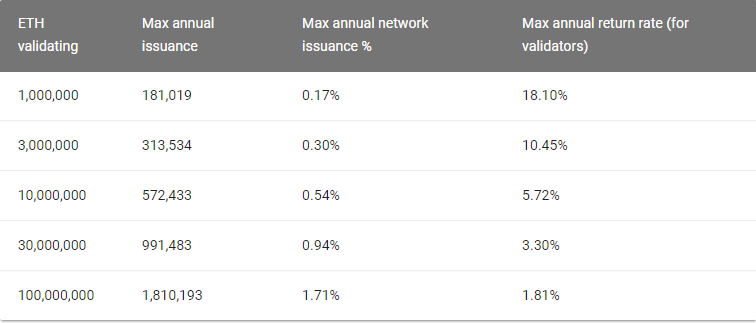

As more validators join the network, the higher the maximum annual issuance will be for the network, but the smaller the proportion of the reward will be for each node. Validators that wish to stake less than 32 ETH can join a staking pool in which collateral is pooled together across multiple validators to form a single 32 ETH node. Validators that wish to stake more than 32 ETH can do so by running multiple nodes. Additionally, probability of getting chosen to create a new block increases proportionally with the amount of ETH staked, as well as the duration of staking, which incentivizes validators to lock in more collateral for longer.

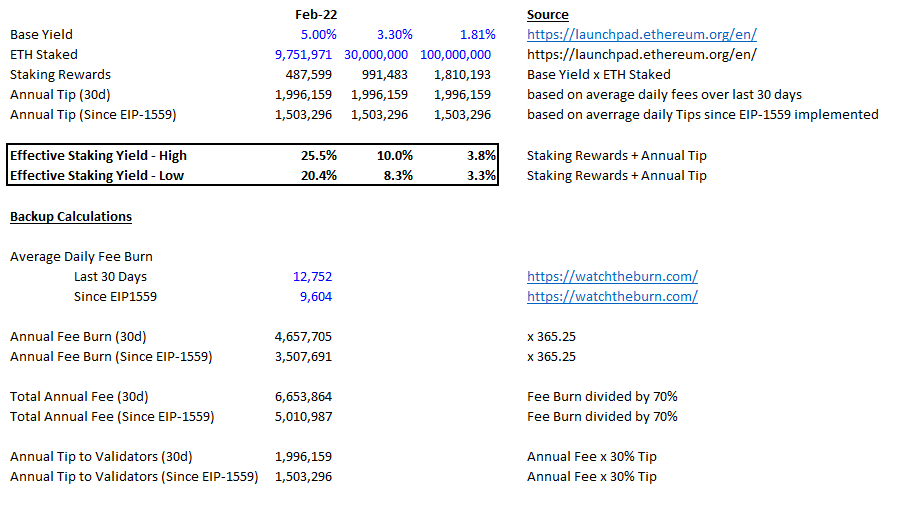

A key distinction of stakers from miners is that they are also “owners” of the network since to be a validator one needs to lock in 32 ETH in collateral. Therefore, stakers care a lot about overall network security and resilience. They benefit from higher ETH price given their exposure to token via staked collateral holdings, as well as staking rewards and the tips they receive (both of which are denominated in ETH). If the transition to Proof-of-Stake occurred today, the realized return for the ~9.7m staked ETH would be very attractive, implying APYs of ~20-25%:

Over time these exceptionally attractive returns are almost certain to be competed away as more and more people choose to stake their ETH tokens to capture the yield (effectively spreading the staking + tip rewards over greater number of staked ETH tokens). This will continue to drive down realized APY until it reaches a steady-state market equilibrium (time will tell what that will be but likely in the low-to-mid single digits). For example, at 100 million tokens staked the realized APY will be in the ~3.5-4% range (assuming current transaction activity).

So why don’t more people stake ETH today? This is because the exact date of the transition to Proof-of-Stake (”The Merge”) is unknown (though expected in H2/2022), and until it is completed staked funds are not available for withdrawal. Given that The Merge has already been delayed multiple times, it is understandable why some people are hesitant to lock up their funds for an undefined period of time. Uncertainty around the implementation of The Merge remains one of the key near-term overhangs on the ETH token price - any additional delays will weigh on the credibility of the dev team and could result in diminished demand for staking ETH. However, once the exact date is announced I expect a lot more people to stake their funds as the liquidity risk will be largely removed.

Network users

Users of the Ethereum network include both individuals and protocols that want to execute a given transaction. “Transactions” can include any of the following use cases: buying/selling/swapping tokens, staking, borrowing, lending, buying/selling NFTs etc. While there are virtually infinite use cases and applications built on top of the Ethereum network, the two primary use cases today that account for the vast majority of network activity are NFTs and DeFi.

At an individual level, network users want fast, cheap, and secure transaction execution. As such, they want to pay the least amount possible for the minimum viable security and incur minimal transaction costs when using the network. The higher the transaction costs, the higher the incentive to switch to alternative Layer 1 networks (such as Solana, Terra, Avalanche). This dynamic manifested itself in 2021, which saw a massive rise in alternative networks as Ethereum transaction costs reached record highs and priced out a lot of the smaller wallet users (see below). For Ethereum to maintain its leadership in DeFi and NFTs over the long-term, transaction costs will have to come down meaningfully (which will likely be achieved through Layer 2 scaling solutions). At the dApp level, “users” want to see continued growth in activity and transaction volumes, both of which are at risk longer-term if transaction costs do not become more affordable, resulting in user migration to alternative blockchains.

Financial investors

These are individuals or institutions that hold ETH tokens purely for financial gain, expecting a return via increase in the price of ETH in fiat terms. Although most actives ETH addresses contain <$100k worth of ETH, the wealth distribution within the Ethereum ecosystem is highly unequal, with top 100 wallets accounting for ~35% of total ETH supply (for reference, top 100 Bitcoin wallets account for ~13.5% of all BTC supply).

Investors care about token price appreciation, as such they want to see minimal to negative token inflation, token price appreciation, as well as security of the network, protecting their capital from permanent loss. I believe that following the full transition to Proof-of-Stake, most long-term financial investors will become stakers to maximize their total return and capture the yield available to stakers. Not doing so would be akin to owning a stock that pays a dividend and actively opting out from receiving the dividend!

It is worth noting that the primary cost for financial investors is opportunity cost of not investing in other protocols. As such, they will only hold ETH as long as they believe that ETH’s expected return is better than any other opportunities in the market on a risk/reward basis.

Ethereum’s Future

The Flywheel Effect

The Proof-of-Stake mechanism creates an interesting feedback loop between stakers and network users. Let me walk you through it.

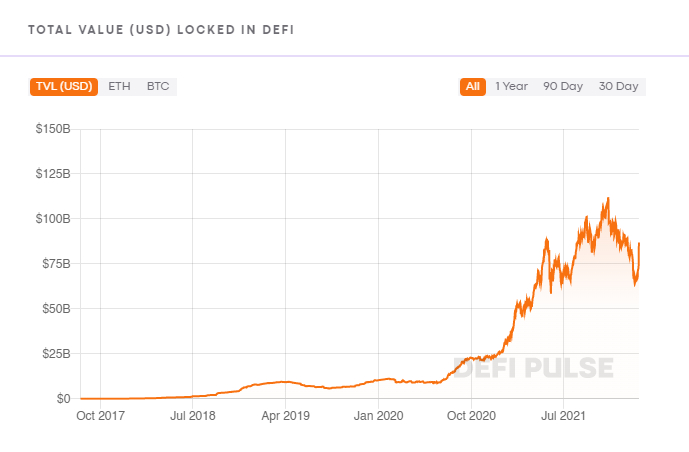

To participate in many DeFi protocols, users need to lock collateral. There’s about 7.6 million ETH locked in DeFi protocols and a total of $133bn of all tokens locked on Ethereum (representing ~60% of all assets locked in DeFi across all blockchains).

Stakers need to lock collateral to validate the network and earn staking rewards. There’s about 9.8m ETH staked today, but as we saw in the analysis above, this number is likely to increase dramatically given the attractive returns staking provides today (especially as date of The Merge is confirmed).

Currently total token supply is 119.5 million ETH, of which ~17 million is locked in DeFi or staking pools, leaving ~102 million ETH in free circulation.

As more and more ETH is taken out of circulation and locked in staking pools, the amount of ETH tokens available to be locked in DeFi (which in itself has experienced exponential growth over the years) will continue to decrease.

Given anticipated limited new token issuance rate under Proof-of-Stake (and potentially even a deflationary token supply given the fee burn), this creates a competition for ETH tokens between staking and DeFi. Assuming DeFi activity continues to rise as more users are onboarded onto the network, the only way for the market to solve this conflict is for the ETH price per token to rise (allowing to support higher DeFi activity in USD terms). Higher ETH price results in higher earnings for stakers, attracting more validators to lock ETH in staking pools, resulting in greater scarcity of ETH to be locked in DeFi, creating a virtuous cycle. In addition, higher transaction volumes mean higher fee burn, resulting in higher deflationary pressure on total ETH token supply (and additional upward pressure on ETH price).

Framework for Valuation: How ETH Can Become a Multitrillion Dollar Asset

Given the flywheel effect explained above, the key assumption for determining Ethereum’s success (or eventual decline) is the level of network activity moving forward. As mentioned above, currently there is about $133bn locked in DeFi on the Ethereum network across all dApps - no small number by any measure. But how high can this number go from here?

A helpful starting point is to look at the total value of traditional assets within the global financial system. Fundamentally, one must believe that we will see increased tokenization of financial assets moving forward, some of which Ethereum will capture in its ecosystem given its superior decentralization and security profile (compared to other major blockchains).

Here are some interesting reference points to help frame the potential upside for Ethereum’s network activity:

Value of circulating USD: $2.1T

Value of global bond market: $119T

Value of global stock market: $125T

Value of global real estate: $326T

Value of total assets of all global financial institutions: $469T

There are many ways to look at value of financial assets globally, but one thing is clear - the current $133bn sitting in Ethereum TVL (and $221bn sitting across ALL blockchains) pales in comparison to the total addressable market. One can take their own view on how much of these assets migrate to decentralized trustless blockchains, but the upside is clearly massive. For example, if 1% of total assets migrates onto Ethereum, this will add some $4.7T of TVL, implying an increase of 35x! This increase in TVL can only be accommodated by an increase in ETH token price, given that total ETH market cap is only $360bn (1/13th of the required TVL). And remember, only tokens NOT locked in staking pools can be used to support this TVL.

To be sure, this won’t happen overnight - this will take time as TradFi institutions are only starting to look at blockchain technology. However, we are only scratching the surface today with existing DeFi solutions - fixed income protocols and on-chain derivatives are in their infancy, and we haven’t yet seen any meaningful tokenization of stocks and real estate at scale.

Risks

The flywheel effect described above can only play out IF and only IF activity on the Ethereum network continues to increase. However, as we discussed above, high transaction costs have resulted in many users migrating to alternative blockchains, stealing meaningful market share from Ethereum in 2021, and who now have sufficient critical mass to build out their own robust DeFi ecosystems. As such, Ethereum’s long-term success depends on its ability to successfully scale its transaction processing rate (TPS) to meaningfully reduce transaction costs for its users.

To address this issue, the network is looking to Layer 2 scaling solutions to boost its transaction processing speed from ~15 TPS to ~100,000 TPS. As outlined by Vitalik Buterin in his “Roll-up Centric Ethereum Roadmap”, it is very likely that once Layer 2’s gain mainstream adoption, most individual users will only use Layer 2’s for 99% of their activity, effectively making Ethereum a “chain of chains” or a global decentralized and secure settlement layer. This means that most of the user activity will permanently live on the Layer 2, and Ethereum will effectively act as a consensus and data availability layer. If successful, this model will enable to onboard tens and hundreds of millions of new users onto affordable and fast Layer 2 chains, while providing the security and decentralization of the underpinning Ethereum network. This would cement Ethereum’s role in the global crypto economy as the base cryptocurrency and will ensure ongoing long-term network demand for ETH tokens (and therefore support higher ETH price). While still in very early days, these solutions have been off to a promising start.

Nevertheless, this is by far the biggest risk to Ethereum - without a burgeoning DeFi ecosystem (supported by affordable transaction costs), Ethereum network becomes a highly decentralized and secure self-licking cone. Put differently, Ethereum’s inability to successfully migrate a meaningful chunk of its users onto the Layer 2 chains will likely result in continued market share loss to alternative Layer 1s as they continue to offer cheap and fast transaction execution and rapidly growing dApp ecosystems. This would directly reduce network activity over time and result in lower rewards for ETH stakers (less ETH burn and less tips), as well as lower competition for ETH tokens between stakers and DeFi, resulting in decreasing ETH price per token. This would result in a cycle of doom driving ETH price lower and lower.

There is also some uncertainty around how proliferation of Layer 2 networks will affect the value capture at the Ethereum level. It is possible that in the short term migration of transactions to Layer 2’s will exert downward pressure on transaction fees earned by ETH stakers, which could negatively affect token price. However, as I explained in my valuation framework, I do not believe it is appropriate to value Ethereum based on its revenues using a DCF - given that Ethereum is more of an economy than a company, it makes more sense to value it based on the TVL that it will support. To read more about the roadmap for Layer 2’s and their impact on Ethereum I suggest checking out this article.

Conclusion

The Proof-of-Stake tokenomics align the incentives of the validators with that of the network for the long-term by providing attractive rewards for securing the network while ensuring that validators have skin in the game (in the form of collateral). The value capture mechanism to ETH token holders via expected deflationary monetary policy (through fee burn) coupled with continued growth in transaction activity (supported by Layer 2 scaling solutions and onboarding of new users) should lead to increasing total fees earned by the network, and therefore, higher rewards to ETH stakers. Further, the increasing competition for limited ETH tokens between stakers and DeFi participants should provide a virtuous cycle resulting in upward pressure on ETH token price in USD. This is my main bull case for Ethereum and why I believe its market cap will be in the trillions of dollars over the long-term. I will continue to accumulate the token into the foreseeable future.

DYOR. Not financial advice. I am irresponsibly long ETH.

Thanks for the write-up Ori!

Great piece